50050 Kuala Lumpur Malaysia. Correctly manage and compute the various employee benefits according to EA using the acceptable legal formula.

For example one employee monthly salarywage is 6000-per month and in any month 30days he worked 15days and avail 2 leave with wage and 4 woff then total pay days is 21days.

. For staff members whose monthly salary is and any increase of salary. Employee start work on 1212016 his salary is RM 1000. 30Working day in the month.

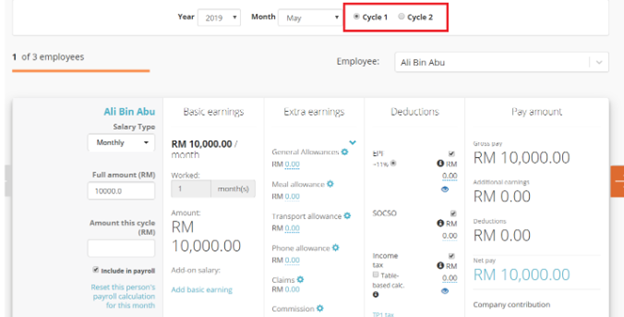

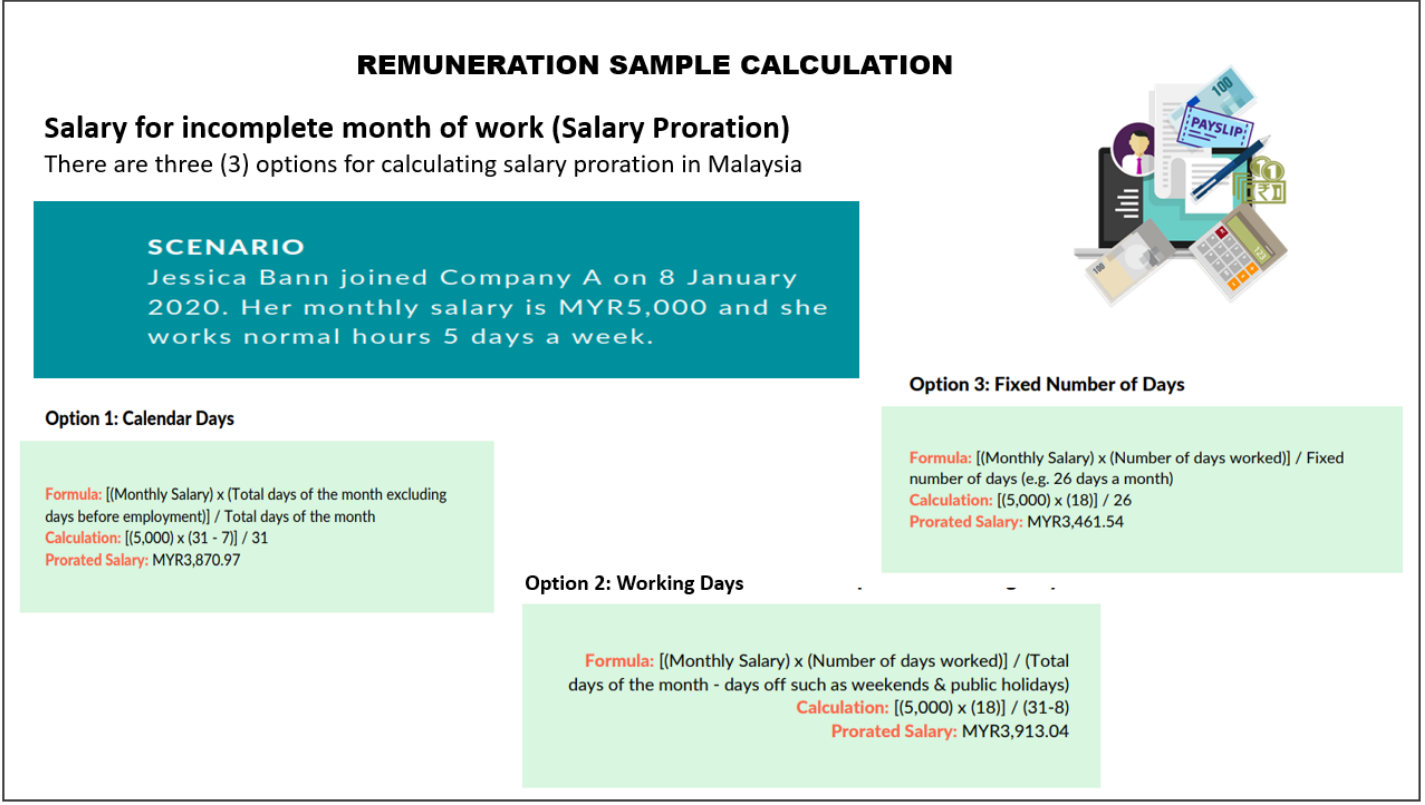

To do this divide the monthly salary by 26 days. Monthly Salary x Number of Days employed in the month Number of days in the respective month. Salary Calculation for Incomplete Month.

Malaysian Labour Law Salary Calculation 2019. An employee monthly rate of pay is always fixed to 26. Posted by Admin.

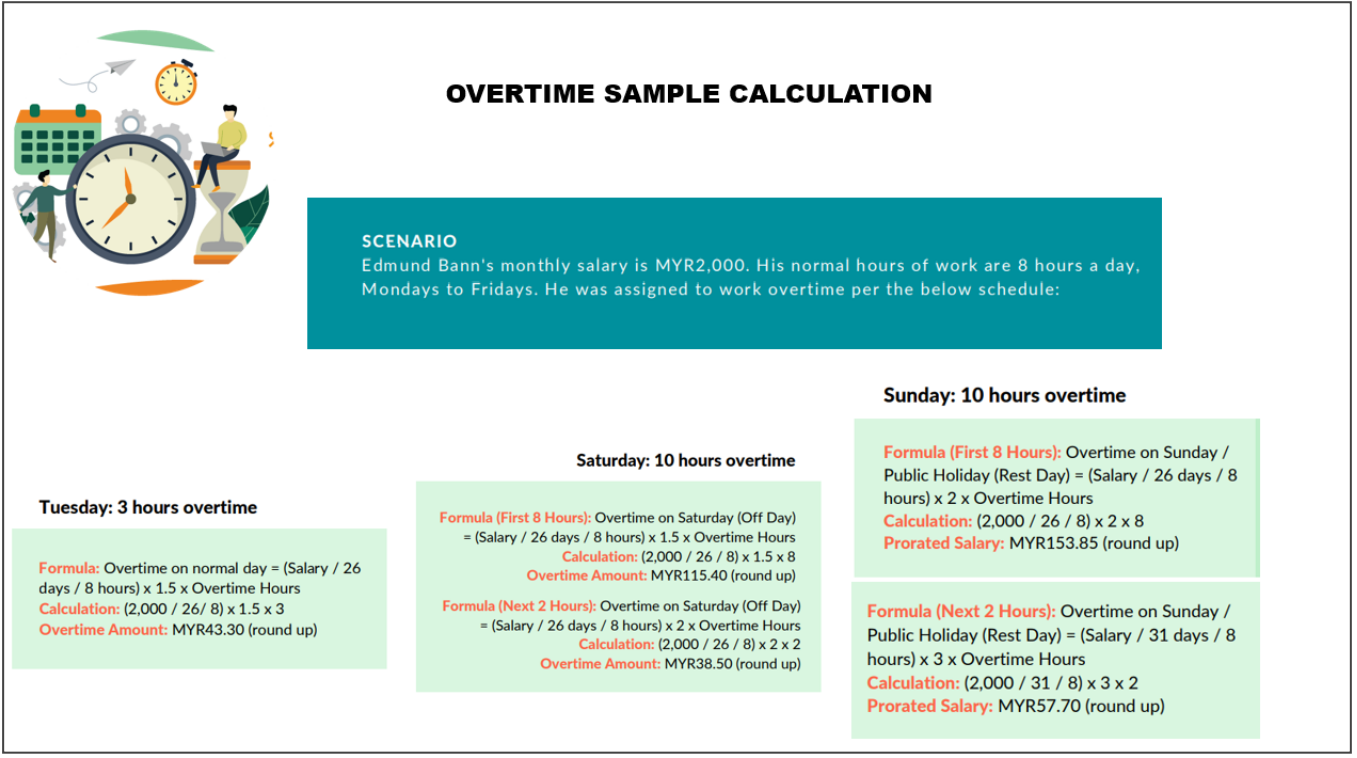

Overtime Rate according to Malaysian Employment Act 1955. Use this number to calculate how much the employee is paid daily monthly salaryworking days in. To calculate the employees ordinary hourly rate of pay youll first need to calculate their ordinary rate of pay daily.

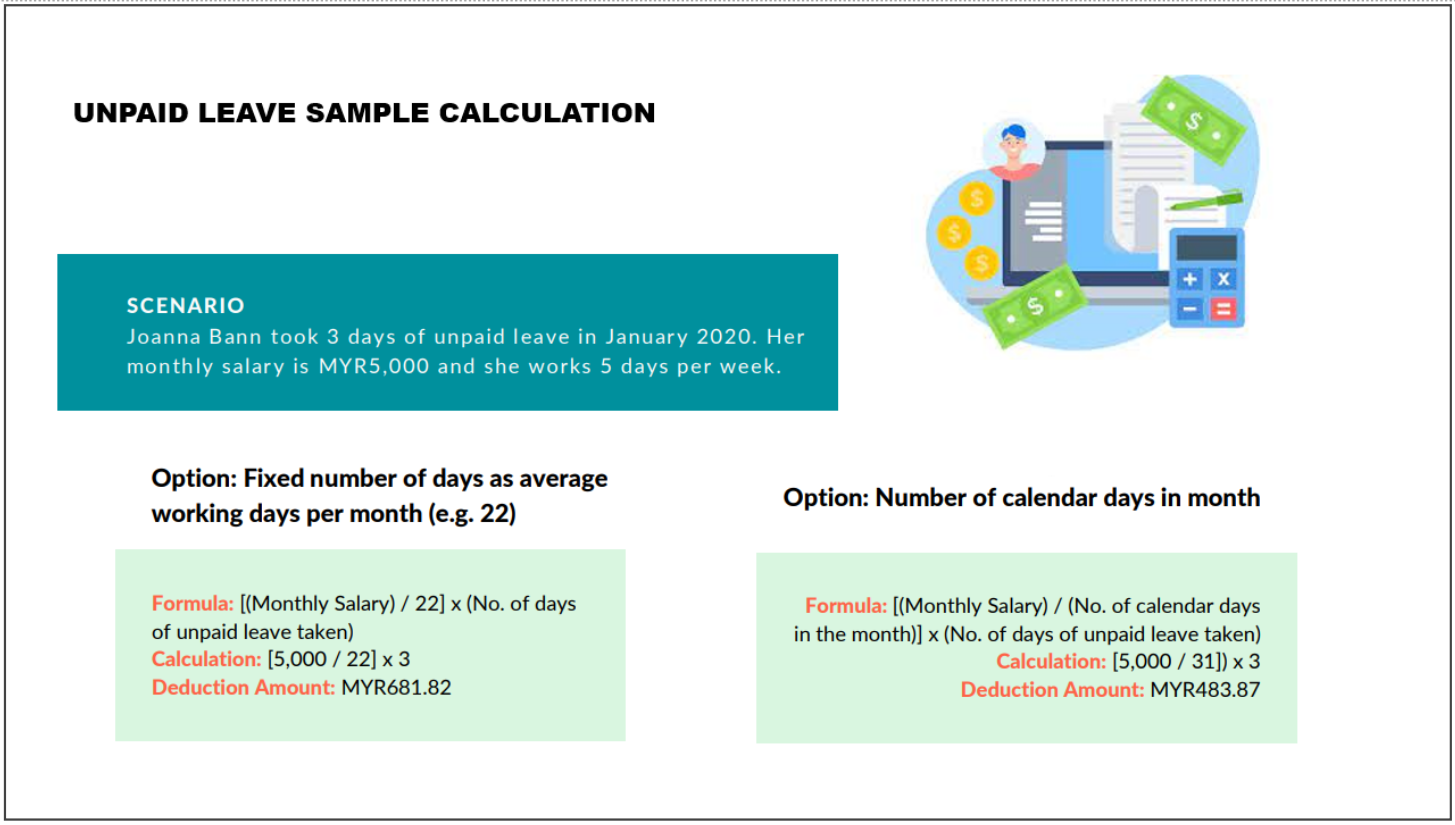

Manual calculation of unpaid leave. RM1000Days in the month. An employee weekly rate of pay is 6.

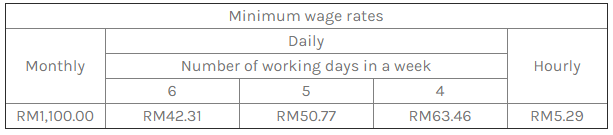

The increase in the minimum monthly wage under the 2020 Order to RM1200 per month in major cities in Malaysia was announced during the 2020 Malaysian Budget. Annual leave sick leave maternity leave public holidays rest days. When an employee receives a monthly rate of pay the ordinary rate of pay should calculate accordingly.

To manually calculate unpaid leave you should ensure that Record Unpaid Leave in Payroll is not ticked under Settings Payment Settings. The main legislation relates to minimum wages in Malaysia are National Wages Consultative Council Act 2011 Act 732 Minimum Wages Order 2020. Monthly rate of pay No.

It can also be called a monthly salary. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a. Find the number of working days in the current month.

How to Perform Salary Calculator Malaysia. 03-2031 3003 Fax 03-2026 1313 2034 2825 2072 5818 E-mail. According to the Employment Act 1955 employers are required to payout monthly wages on the seventh day of the following month.

Worker work 20 days he get pay of RM1000 fair enoughScenario B. In addition the 2020. To calculate the daily rate you can divide the.

Normal working hours 1. When an employee joins a company or ceases employment during a month thereby having an incomplete month of service the salary payment may have to be apportioned accordingly. Paying employee wages late.

Calculate your income tax in Malaysia salary deductions in Malaysia and compare salary after tax for income earned in Malaysia in the 2022 tax year using the Malaysia salary after tax. Salary Formula as follows. RM1800 RM26.

In Malaysia matters concerning working hours and wages are regulated under the Employment Act 1955 and Minimum Wages Order 2016. Of work days in the relevant month. Easy to read guide that answers all the important questions about employee benefits and employment law in Malaysia ie the Employment Act 1955 and others.

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Everything You Need To Know About Running Payroll In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Everything You Need To Know About Running Payroll In Malaysia

Employment Law New Minimum Wage Rates To Take Effect On 1 February 2020 Lexology

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Formul St Partners Plt Chartered Accountants Malaysia Facebook

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Salary Calculation Dna Hr Capital Sdn Bhd

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

Employment Act 1955 Salary Calculations And Benefits Marm

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog